unified estate tax credit 2019

Confused about the new tax provisions. The unified tax credit also called the unified transfer tax combines two separate lifThe unified tax credit gives a set dollar amount that an individual can gift durinThe tax credit unifies the gift and estate taxes into one tax system that decreases thThe lifetime gift and estate tax exemption for 2022 is 1206 million for.

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

The IRS has issued tax year 2019 inflation adjustments for more than 60 tax provisions including tax rate schedules.

. Ad Unified estate tax credit 2019. Get information on how the estate tax may apply to your taxable estate at your death. The estate and gift tax exemption is 114 million per individual up from 1118 million in 2018.

To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit. Unified credit against estate tax. Learn More at AARP.

6 Often Overlooked Tax Breaks You Dont Want to Miss. Unified Estate Tax Credit 2019. If you were married your spouse also a us.

The threshold for the Maryland estate tax is currently 5 million. If youd prefer to give. Talk about the Dark Ages.

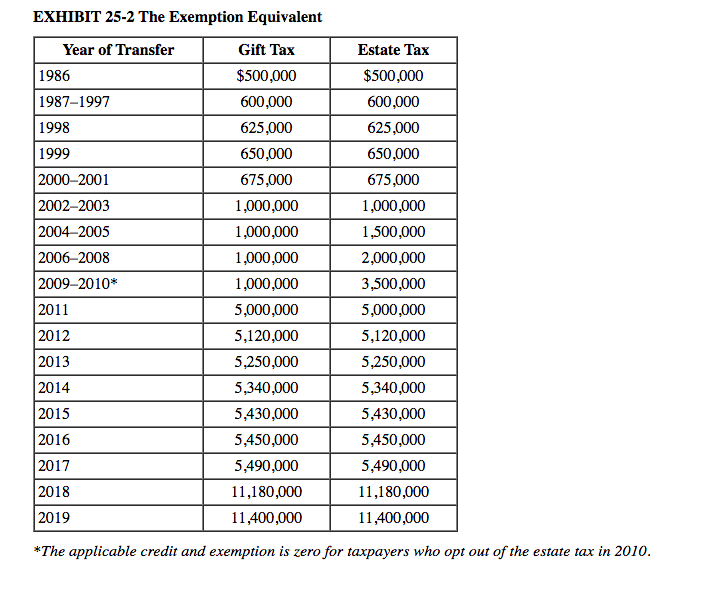

But all of this is more complicated than it has to be from a taxpayers standpoint. The unified estate and gift tax credit exempts people with taxable. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

RAccounting 1 hr. Opinion on unified estate and gift tax credit exempt. Register and Subscribe Now to work on your IRS 1041 more fillable forms.

Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million. The unified credit is equal to. Unified credit against estate tax Text contains those laws in effect on January 7 2011.

Browse Our Collection and Pick the Best Offers. But all of this is more complicated than it has to be from a taxpayers standpoint. The Maryland Estate Tax-Unified Credit Act altered the unified credit used for determining the amount that can be excluded for Maryland estate tax purposes.

Estates of decedents who die during 2023 have a basic exclusion amount of 12920000 up from 12060000 in 2022. Under current law the threshold will only be adjusted. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been.

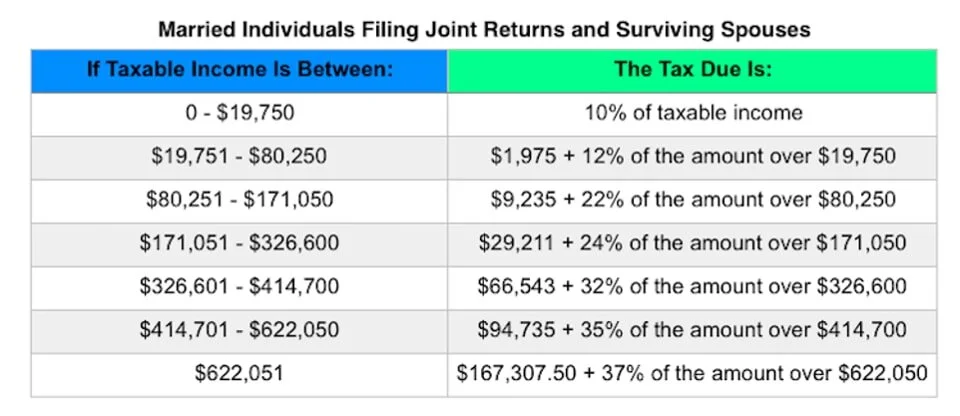

Once you have the lifetime exclusion amount you can figure out the amount of the unified credit by running it through the brackets above. The tax is then reduced by the available unified credit. Ad Browse Discover Thousands of Law Book Titles for Less.

The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others. Check Out the Latest Info. Up from 1118 million per individual in 2018 to 114.

A tax credit that is afforded to every man woman and child in america by the irs. Unified credit against estate tax a General rule. The Homestead Credit limits the increase.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. Unlike the federal estate tax the credit amount is not indexed for inflation.

That means an individual can leave. Doing the math the 2019 unified credit. Is added to this number and the tax is computed.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The tax reform law doubled the BEA for tax-years 2018 through 2025. Then we moved into the step up of the Credit over 10 years the Unified Credit went from 300000 for two years 400000 for two years 600000.

Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. A deceased spousal unused exclusion amount may not be taken into account by a surviving spouse under paragraph 2 unless the executor of the estate of the deceased. A credit of the applicable credit.

They also announced the official estate and gift tax limits for 2019 as follows. Once you have the lifetime exclusion amount you can figure out the amount of the unified credit by running it through the brackets above. Doing the math the 2019 unified credit.

Exploring The Estate Tax Part 1 Journal Of Accountancy

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

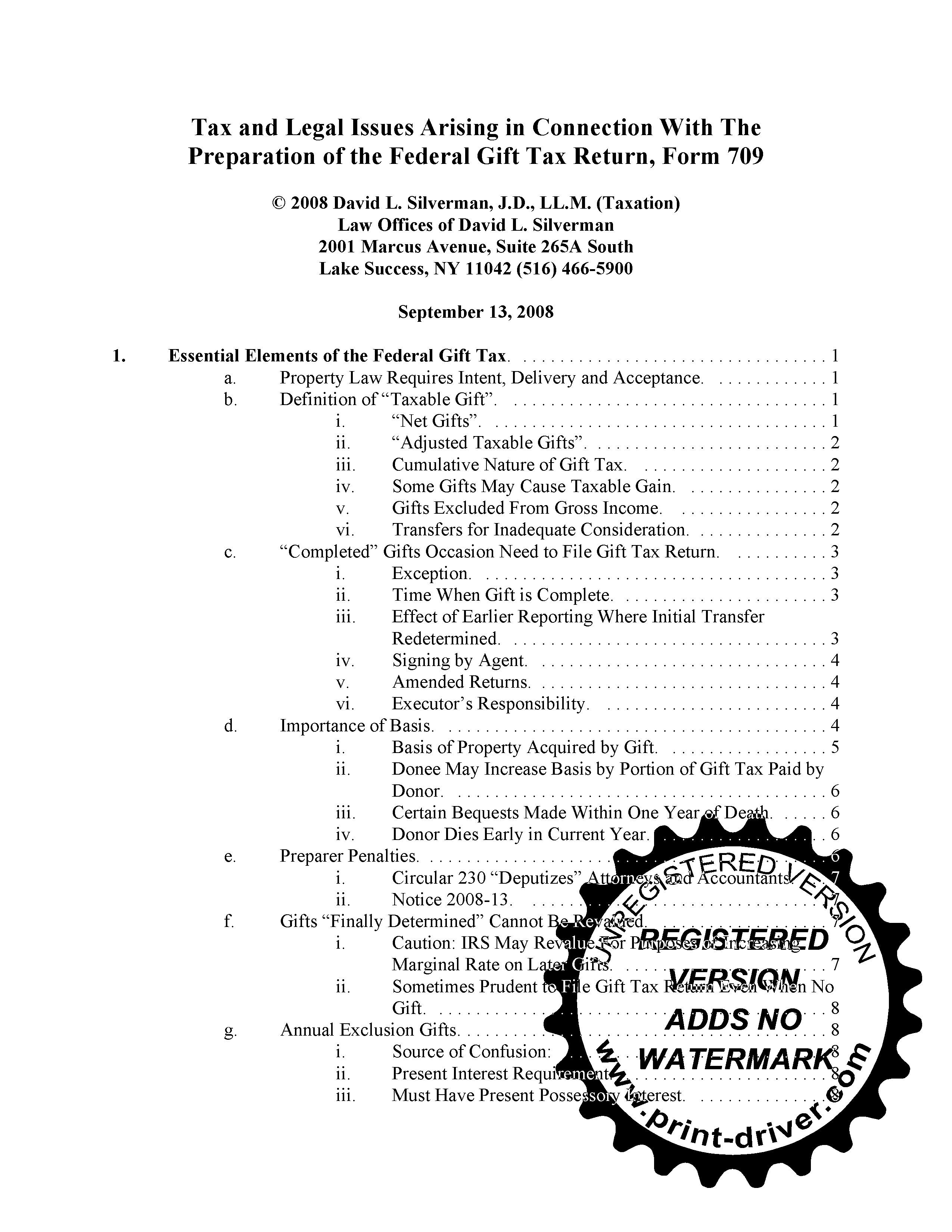

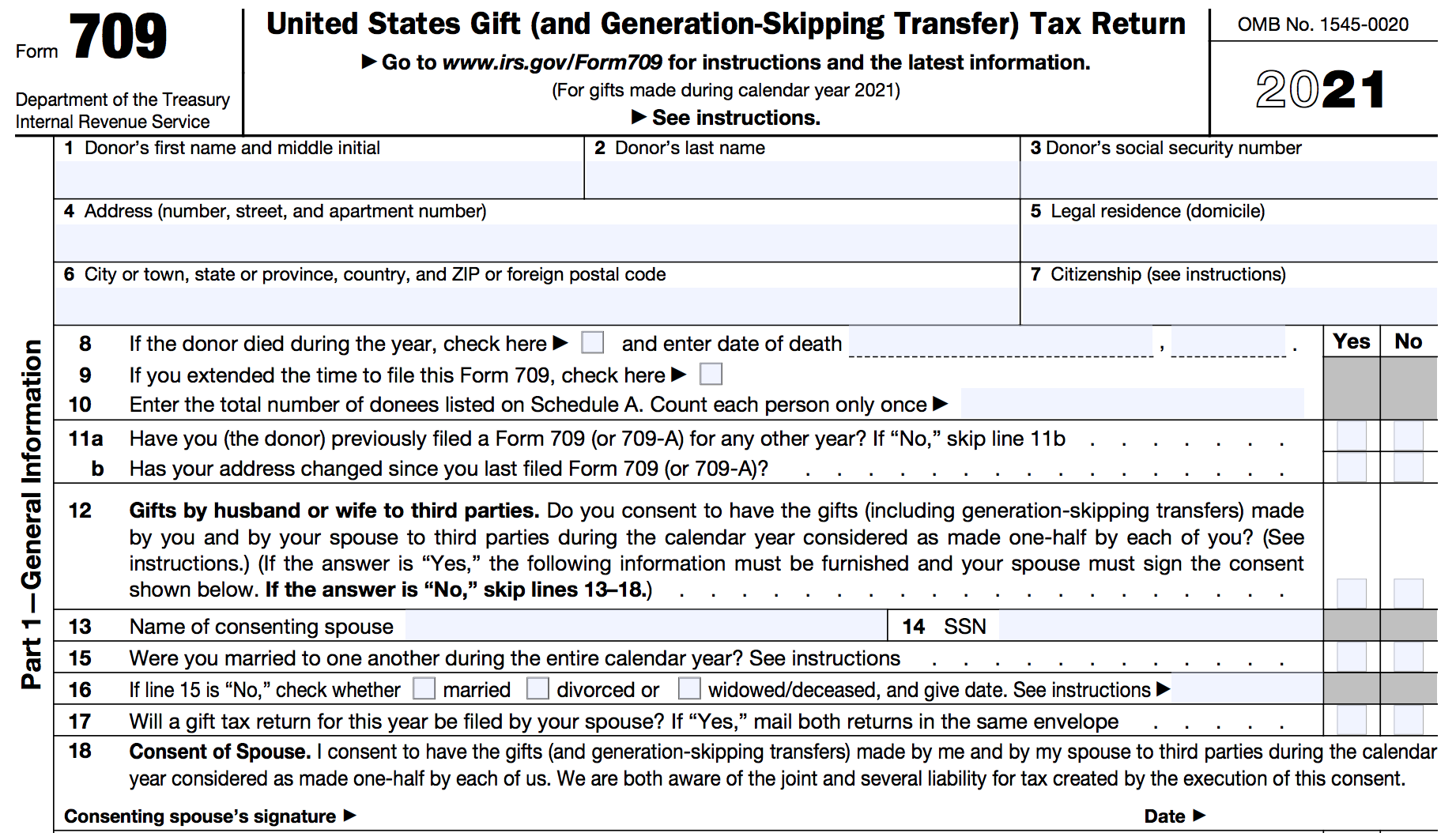

Tax And Legal Issues Arising In Connection With The Preparation Of The Federal Gift Tax Return Form 709 Treatise Law Offices Of David L Silverman

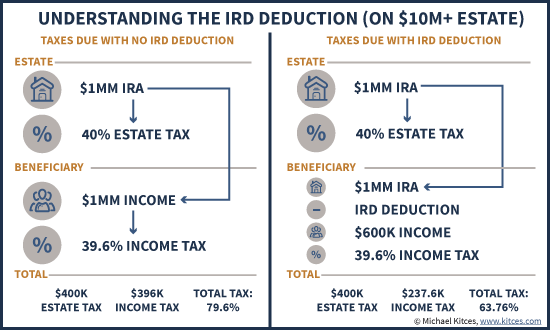

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

An Introduction To Taxation And Understanding The Federal Tax Law Ppt Download

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Solved Exhibit 25 1 Unified Transfer Tax Rates Plus Of Chegg Com

Pdf The Federal Estate Tax History Law And Economics Semantic Scholar

Estate Tax In The United States Wikipedia

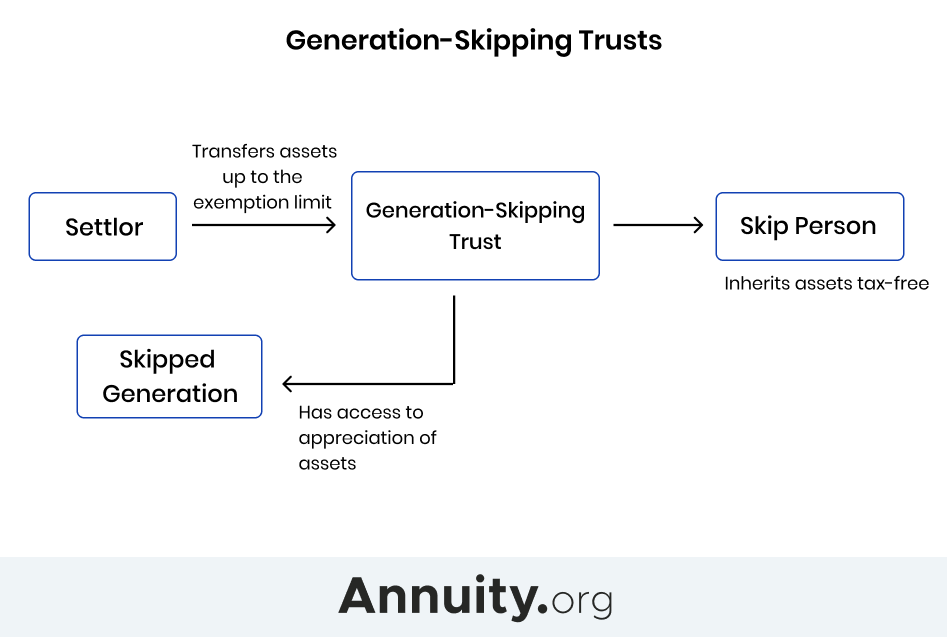

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Irs Announces Higher 2019 Estate And Gift Tax Limits

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Generation Skipping Trust Gst What It Is And How It Works

Federal Estate Gift Taxes Code Regulations Including Related Income Tax Provisions As Of March 2019 Cch Tax Law Editors 9780808048091 Amazon Com Books

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj